How Do Insurance Companies Pay Out Claims in Texas?

The Lane Law Firm | Dec 8, 2021

If your home has been damaged, knowing when you'll be able to make your repairs and be reimbursed for those expenses is important. So, how do insurance companies pay out claims in Texas, and how long will it take for you to receive your claim?

How Do Insurance Companies Pay Out Claims in Texas?

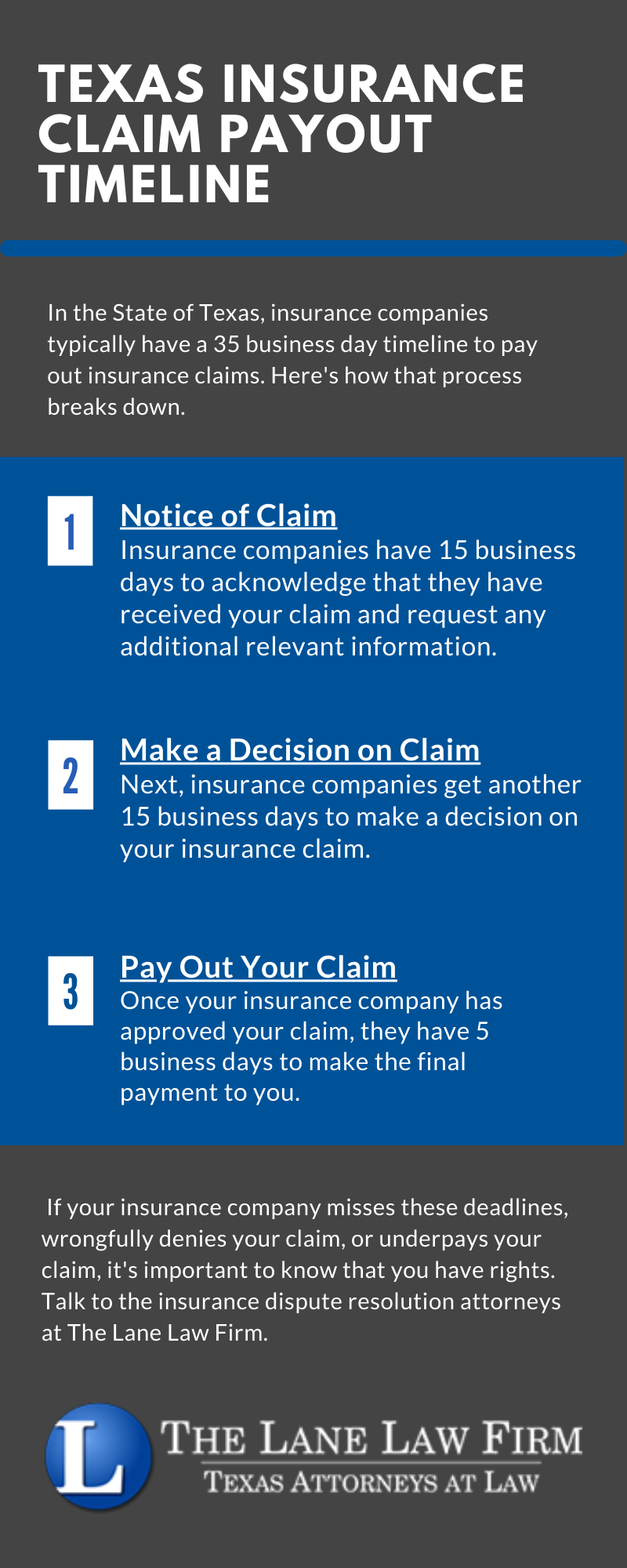

In the State of Texas, insurance companies must pay out claims within 5 business days of approving a claim, but there are a few steps the insurance company must go through before they approve a claim. On average, the entire process should take around 35 business days from when you submit your claim, to when you're paid. Let's take a look at how that breaks down:

1. Notice of Claim

After you submit a claim to your insurance agency, they have 15 business days to respond. How to File a Homeowner's Insurance Claim After an Incident, breaks down each step in filing a claim. In those first 15 days, your insurance agency must:

- Acknowledge that they received the claim

- Begin their investigation

- Request any and all relevant information from you in order to continue with the claim investigation.

This is the setting-up phase of the process. At this point, your insurance agency is collecting the documents they need to evaluate your insurance claim.

2. Make a Decision on Claim

In the State of Texas, insurance companies have another 15 business days to make a decision on your claim after they have received any additional documentation from you.

During this time, your insurance agency will review the documents you've provided and decide whether to approve or deny your claim.

3. Pay Out Your Claim

Once your insurance agency has approved your claim, they have 5 business days to make the final payment to you.

What if My Insurance Company Misses Any of Those Deadlines?

If your insurance agency misses any of the deadlines in your claims process, they are in violation of Texas's Insurance Code.

While there are some instances where insurers may be able to extend their 15-day response period to 45 business days, they must have the appropriate basis for that extension. Any delay beyond an appropriate extension also puts your insurance company in violation of Texas's Insurance Code.

What if I Disagree with the Amount My Insurance Agency Gave Me for My Texas Claim?

Even when you do receive your insurance claim payout on time, it's not uncommon for insurance agencies to underpay claims. This happens when they give you less than what you actually need to cover the property damages on your home. If you've read your insurance policy thoroughly and are confident you've been underpaid, you can dispute a claim.

What if My Insurance Company Denies My Claim?

If, after the second 15 business days, your insurance company denies your claim, they must give a reason for denial. When they do so, it's important for you to make sure their reason for denial matches up with your insurance policy. You can file a formal appeal for your claim if the reason for denial doesn't add up or you believe that your insurer falsely denied your claim.

Who Can Help Me Appeal an Insurance Claim, or Hold an Insurance Company Responsible for Violating Texas Insurance Code?

If your insurance company continues to drag out your claim, or if they have wrongfully denied your claim, it's important to know that you have rights in the state of Texas. An experienced property insurance attorney can help you file a formal appeal for your claim or hold an insurance agency responsible for delaying a claim payout. If you have questions about your claim, starting a formal appeal, or anything else related to a delayed or wrongfully denied insurance claim in Texas, talk to The Lane Law Firm. Our property insurance attorneys have decades of experience winning our clients the claims they are due. Give us a call or contact us online today.